Now that in good European tradition many of us are still enjoying long holidays before kicking off again in September (in France there is even an expression for it “La Rentrée” as the whole country kind of returns to normal life at the same time), maybe it’s a good moment to reflect on the early stage market.

In recent months, the financial media has been writing many negative headlines about the early stage market and it is easy to become overly downbeat. As we remember it all started with YC releasing a memo to founders advising them to plan for the worst (read it here)

Three months down the road we can see that the sky has not been falling and maybe there was a bit of overblown fear mongering. I believe it’s not all doom and gloom. For the later stage companies raising funds things certainly have really changed drastically as they are more correlated to what happens in public equities (hopefully the July rally continues!).

For early stage (Series A and earlier), I believe things are not so bad as some people think and some cautious optimism is warranted.

Maybe the correction is even healthy for the market. Yes, fundraising might take a bit longer; round sizes may be a little smaller and valuations may be a little lower (not always!). But we see things are still getting done and reality is that many startups are actually growing significantly ahead of target.

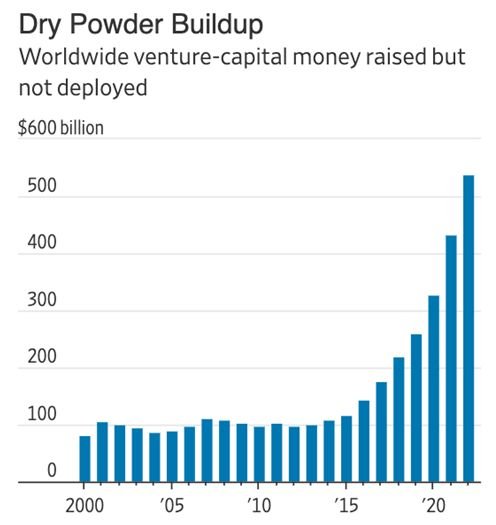

Investors might ask more proof and ask more questions. But there is so much money in the system via new and old funds that has to find its way to startups. For founders who can demonstrate that growth, we see things are moving. Indeed as always, sales can solve all problems for early stage startups.

It can even be argued that the current environment might actually be the ideal time for venture capital and angels to invest in startups.

Compared to previous years when sometimes valuations went too high, now there is a possibility to invest at realistic valuations (also due to less competition) and to create a vintage that has all chances of showing very nice returns for investors when it will be time to harvest in say 5 or 7 years.

Looking back at previous cycles it can also be argued that these periods are actually good for innovation. Many companies that are now well-known unicorns such as Uber, WhatsApp and Groupon were actually started during or in the early years after the global financial crisis of 2008. Capital is there and things will settle down. The global trends are strong and have not changed.

Digital transformation which got a mega-boost due to the global pandemic will continue on aggressively.

In a nutshell, I believe that the fact that the market is reorganising itself and getting back to normal behaviour is a good thing for the investor and offers them a real opportunity. And disciplined founders will come out of this stronger, can recruit rare talent easier and are the ones that may take advantage of the situation, creating the next success stories.

This graph is also quite revealing:

Enjoy the rest of August!

Patrick Soetens – Founder of Finwise